Badewanne. Warum das Material bei der Badewanne so wichtig ist Wenn ich an meine erste Badewanne zurückdenke, fällt mir sofort das Material […]

SanctuaryVF™

Tapete

Tapete. Warum die richtige Vorbereitung bei der Tapete so wichtig ist Wenn ich zurückdenke an meine ersten Tapezier-Versuche, merke ich erst, wie […]

Gartendusche

Gartendusche. Warum eine Gartendusche im Sommer unverzichtbar ist Im Sommer gibt es kaum etwas Erfrischenderes als eine schnelle Abkühlung im eigenen Garten. […]

Barhocker

Barhocker. Warum die richtige Sitzhöhe bei Barhockern so wichtig ist Als ich das erste Mal Barhocker für meine Küche ausgesucht habe, dachte […]

Vordach

Vordach. Warum ein Vordach mehr als nur Schutz vor Regen ist Ich erinnere mich noch gut, wie ich das erste Mal ein […]

Sanremo

Sanremo. und seine bezaubernde Blumenpracht Sanremo ist berühmt als die „Stadt der Blumen“. Wenn man durch die Straßen schlendert, begegnet man überall […]

Balkonset

Balkonset. Warum die Wahl des richtigen Balkonsets so wichtig ist Ich sag’s dir, Balkonset kaufen ist nicht einfach nur “Tisch und Stühle […]

Fototapete Fridge

Fototapete Fridge. Warum eine Fototapete auf den Kühlschrank eine coole Idee ist Ehrlich gesagt, war ich anfangs ziemlich skeptisch, ob so eine […]

Gartenzaun Holz

Gartenzaun Holz. Warum ein Holz-Gartenzaun die beste Wahl für deinen Garten ist Holz als Material für den Gartenzaun hat für mich immer […]

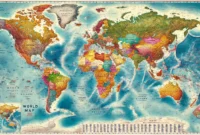

Landkarte Weltkarte Länder

Landkarte Weltkarte Länder. Warum Landkarten im Blog mehr bringen als nur hübsche Bilder Wenn du mich fragst, Landkarten sind so viel mehr […]